The California housing market has been picking up momentum since jobs have become less scarce and mortgage rates are reaching all-time lows. It is a perfect time for first time homebuyers to capitalize. With that said there are a few critical mistakes a buyer must watch for:

- Mistake #1: Not planning ahead.

Once you have narrowed down your search and you’re ready to make on offer, confirm the demand with your agent. Take into account the amount of time the house has been on the market and what the average asking price is. Make sure you get an inspector with expertise to check the utilities for damage. Assure it is someone competent, not just an inspector from a real estate broker. Consider chances for resale and the school district, because even if you don’t have children or plan on having any, the next buyer might.

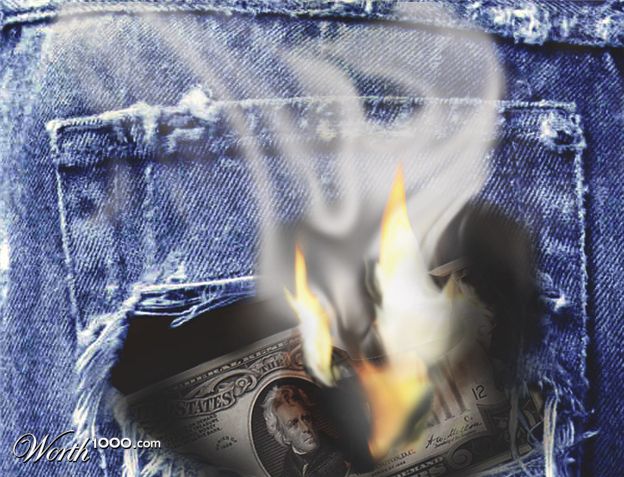

- Mistake #2: Overestimating what you can afford.

It’s critical a buyer takes into consideration that monthly payments include not just the mortgage, but interest, taxes and insurance, something buyers often forget when figuring out a budgets. It’s a good idea to get pre-approved for a mortgage loan so you know how much a bank is willing to lend you before you make an offer on a home. But keep in mind that the amount you’re pre-approved to borrow from a mortgage lender may be more than you can actually afford once you factor in taxes, insurance and other costs. Your total monthly payment shouldn’t exceed 28 percent of your gross, or pretax, income. Although some sellers are still asking for 20 percent down payments, it’s possible to pay much less. Mortgage giants Fannie Mae and Freddie Mac announced guidelines late last year for loans with down payments as low as 3 percent under a new program largely aimed at first-time homebuyers. Just remember that the lower your down payment, the bigger your mortgage loan.

- Mistake #3: Don’t let emotions juristic your purchase

Getting too emotionally attached can set you up to spend irrationally. It’s recommended to account for what you want in your home. Make a list of the most important qualities, whether you want a certain school district, updated bathrooms, a backyard, etc. Then figure out what you aren’t willing to compromise. You won’t find an exact match, so narrowing it down to what matters most can help guide your decisions.